Hi there!

A quick reminder—last week, I launched a free email course called 5 Days to Better Content Marketing. So far, 178 people have signed up. One reader sent me this note:

"Loved the series! The everyday emails made it easy to digest the content and commit to learning on an ongoing basis. You should do more of these."

I updated the course with a few free worksheets. If you interested, you can sign up here.

Sponsored

Your Amazon wishlist at your price

Did you know that Amazon changes prices up to 80 million times each day? ShadowBid helps you get the best price on the items you want. Just download the free app or Chrome extension, then:

- select any Amazon product you want

- review price history chart

- set your desired price

- ShadowBid automatically purchases at your price

Customers are saving between 20% and 60% on Amazon. Download ShadowBid for free and you'll never overpay again!

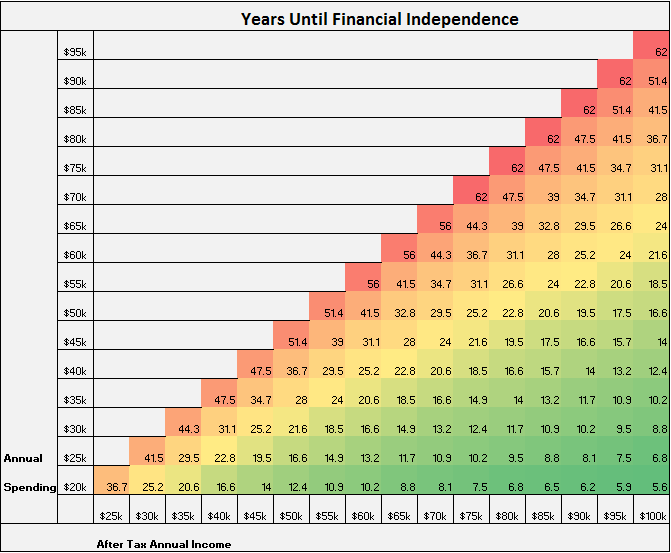

1. The Early Retirement Grid

This is a really cool article I found via J.D. Roth's Twitter (a great person to follow by the way). Simple math + compounding interest are really, really powerful.

Clearly from this grid you can see the importance of making the gap between your income and spending as wide as possible. If you can earn $90,000 per year and only spend $20,000 you only need to work for 6 years to have enough money to support you for the rest of your life. But if you earn $90,000 and are spending $85,000 it will take you over 60 years to retire.

2. How I Learned to Believe in Myself

Another winner from Ramit Sethi who, for my money, is one of the interesting and powerful bloggers out there.

But I see people paralyzed by the end result. Instead, I forced myself to start off small and stay consistent. For example, I know a guy who constantly lectures me on health stuff he reads online like ketosis, Paleo, intermittent fasting. Yet he’s still overweight! I would rather be the guy known for putting in small steps — working out 3x/week — than for having an encyclopedic knowledge of health.

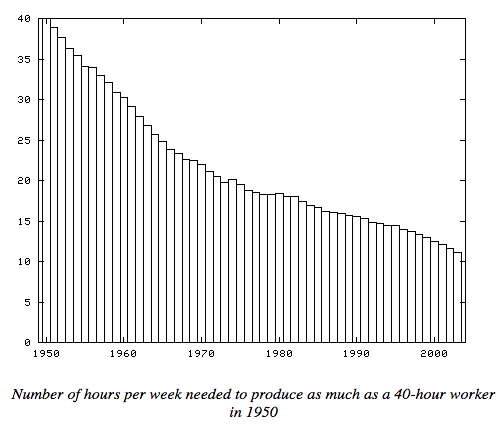

3. Productivity and the Workweek

This is a very interesting article from professor Erik Rauch. One very important point he raises: who benefits from your increased productivity? In almost all cases, not you.

An average worker needs to work a mere 11 hours per week to produce as much as one working 40 hours per week in 1950. The conclusion is inescapable: if productivity means anything at all, a worker should be able to earn the same standard of living as a 1950 worker in only 11 hours per week.

4. App of the Week: Todoist

On Monday of this week, I tweeted that I need a project management tool for myself. I got some great suggestions and decided to try the premium version of Todoist. I'm really impressed so. It's really lightweight, but can handle whatever I throw at it.

I also found Francesco D'Alessio's tutorial videos to be really helpful.

5. Random Links

- I created two worksheets to help you come up with 50 blog topics. Download them here.

- The Kennel Club's Dog Photographer of the Year contest results are awesome.

- Speaking of dogs, this video of a yellow lab opening a fridge will make your day.

- NudgeMail is a free alternative to FollowUp.cc (a tool I can no longer live without).

- Here's a great idea (journaling) buried in a crappy article.

- Snapchat's "Featured stories" look more like more like Forbes "Around the web" every day

Have a a great week!

Jimmy